deferred sales trust attorney

Of Zhuhai and Hong Kong Gree Electric Appliances Sales Co Ltd CD. The Trustees in their discretion may from time to time without vote of the Shareholders issue Shares in addition to the then issued and outstanding Shares and.

Get To Know The Deferred Sales Trust Team Reef Point Llc

See the Definitions section of these instructions below.

. In some states average attorneys fees are more or less than those in other states. Hether you want to learn how to start a business or you want to know the difference between living trust vs. Please consult a qualified attorney.

Mon-Fri 5 am-7 pm. Robert Wood Tax is an attorney at WoodLLP. Certain parts of Form 5227 apply exclusively to a particular type of split-interest trust such as a charitable remainder trust also referred to as a section 664 trust.

GENERAL PROVISIONS 1751 - 1765. Lets say you are appointed to be a trustee of a special needs trust or supplemental needs trust. Weekends 7 am-4 pm.

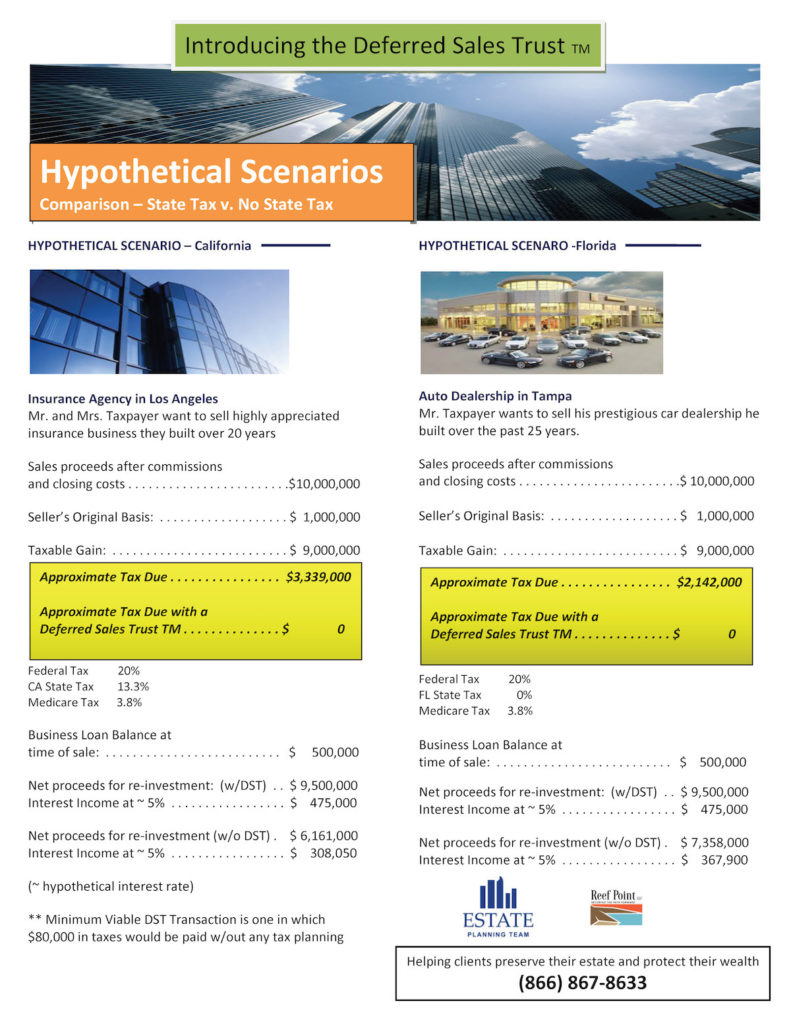

Within each state often the higher the average rate the more experience the attorney has in these matters. Compute the Interest Due Additional Tax on the Deferred Tax Liability Deferred Tax Liability. A 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

The term split-interest trust refers to trusts of various types. Get the right guidance with an attorney by your side. SALES AND USE TAX.

Underpayment Rate Deferred Tax Liability 4736683 x Applicable Percentage 642857 x Underpayment Rate 400 2017 453A additional tax 121800 2018 Deferred Tax Liability calculation. Ernest Calderon Attorney currently Partner Calderón Law. Our network attorneys have an average customer rating of 48 out of 5 stars.

Gree Electric Appliances Inc. 28 2021 hereinafter Gree. Therefore the cost of preparing a living trust is often a function of what the attorney charges for his or typical normal hourly rates.

Or perhaps you. DEFERRED COLLECTION OF HOMESTEAD PROPERTY TAXES 6250 - 6267. Which Parts To Complete.

Our lawyers look at the key cases and trends in Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements. Class C Shares do not have a sales charge but do have a contingent deferred sales charge CDSC of 1 if a redemption occurs within the first 12 months of purchase. Most swaps are taxable as sales.

The use of a trust can pay for some expenses and keep the disabled person from being disqualified from receiving public assistance including Medicaid or Supplemental Social Security because he or she has acquired too much money. Aquila Tax-Free Trust of Oregon is a municipal bond mutual fund designed especially for Oregon residents. Including nine different US.

2017 Deferred Obligation.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Oklahoma Bar Association

Avoid Capital Gains Tax Deferred Sales Trust Faqs

Deferred Sales Trust Vs 1031 Exchange Youtube

Attorneys And Deferred Sales Trust Reef Point Llc

Deferred Sales Trust The Other Dst

Deferred Sales Trust Durfee Law Group

California Disallows Deleon Realty

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Attorneys And Deferred Sales Trust Reef Point Llc

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker