extended child tax credit portal

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. Previously the credit was 2000 per child under 17 and.

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17.

. The Child Tax Credit was significantly expanded in 2021 by the American Rescue Plan so families could receive up to 3600 per child under 6 and 3000 for those ages 6 to 17. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. The American Rescue Plan signed into law by President Biden expanded the Child Tax Credit for 2021 to get more help to more families.

Increased the credit from. But the changes were. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Tax season brings its fair share of uncertainty for us non-CPAs and thats even more true this year. Who Qualifies You can claim the.

Get this years expanded Child Tax Credit File your taxes to get your full Child Tax Credit now through April 18 2022. The legislation made the existing 2000. The Child Tax Credit will help all families succeed.

The Child Tax Credit helps families with qualifying children get a tax break. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Get help filing your taxes and find more information about the 2021. As part of its COVID-19 relief package Congress has changed the requirements and amounts of certain tax credits hoping to ease the financial burden weighing on many familiesOne of the biggest changes has been the expansion of two tax credits the child tax. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

The American Rescue Plan. The Child Tax Credit Update Portal is no longer available. In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and.

As part of the American Rescue Act signed into law by President Joe Biden in. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. You may be able to claim the credit even if you dont normally file a tax return.

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

The Child Tax Credit Portal Is Now Live Youtube

Parents Guide To The Child Tax Credit Nextadvisor With Time

As Child Tax Credit Payments Begin Biden Prepares To Speak The New York Times

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

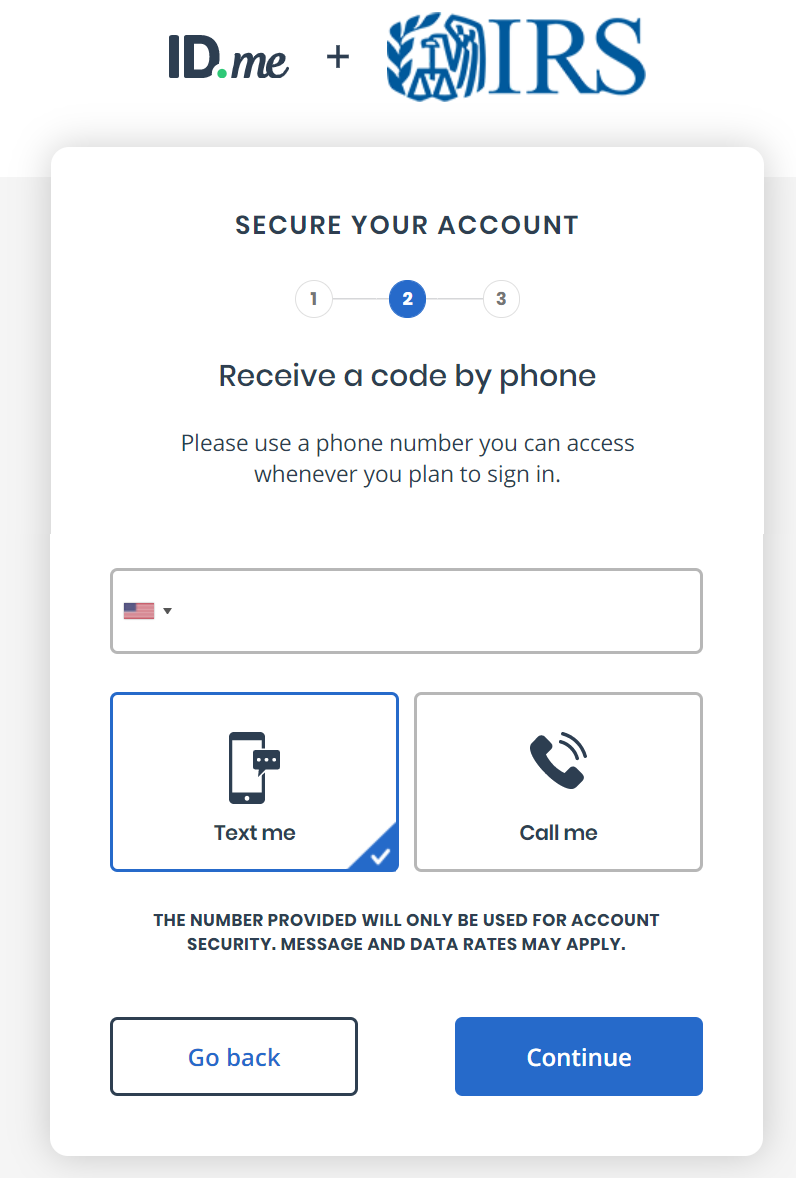

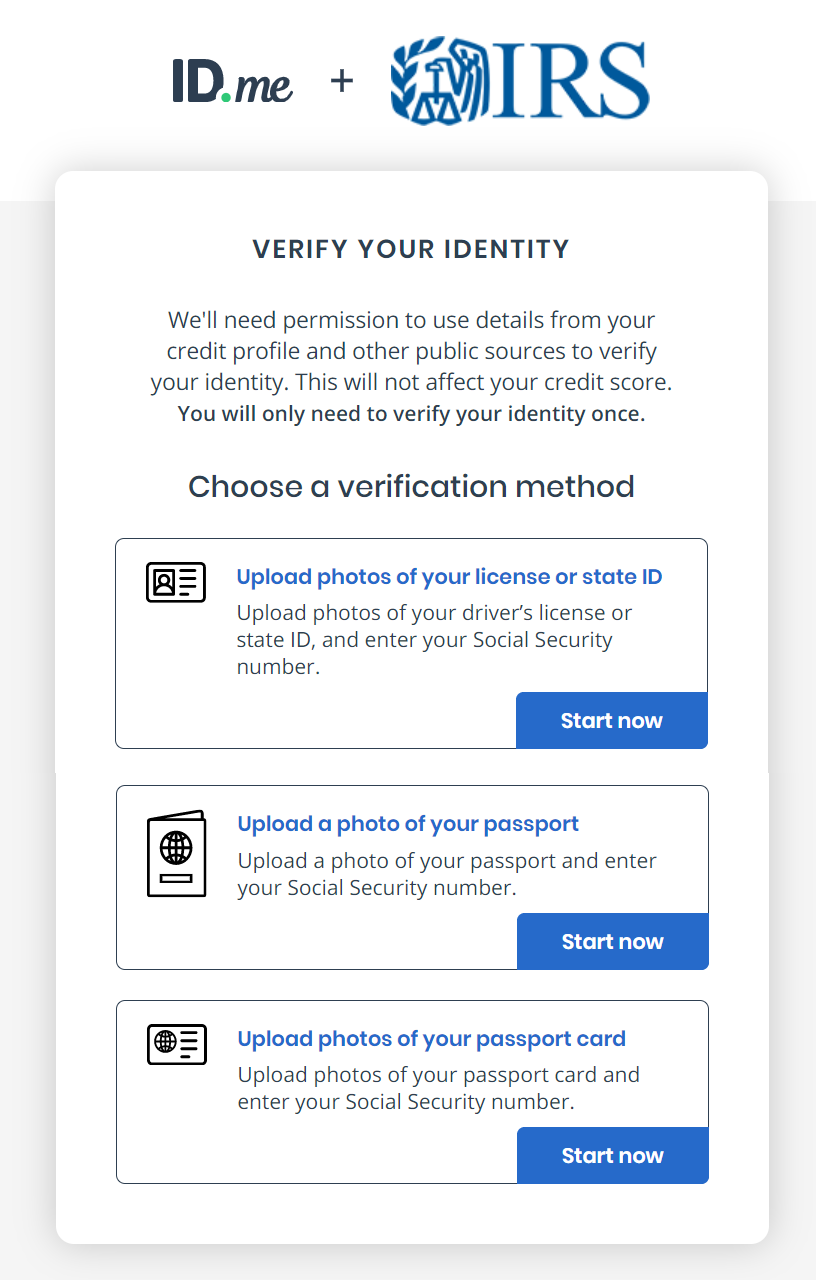

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advance Payments Claim Advctc

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Expanded Child Tax Credit Senator Patty Murray

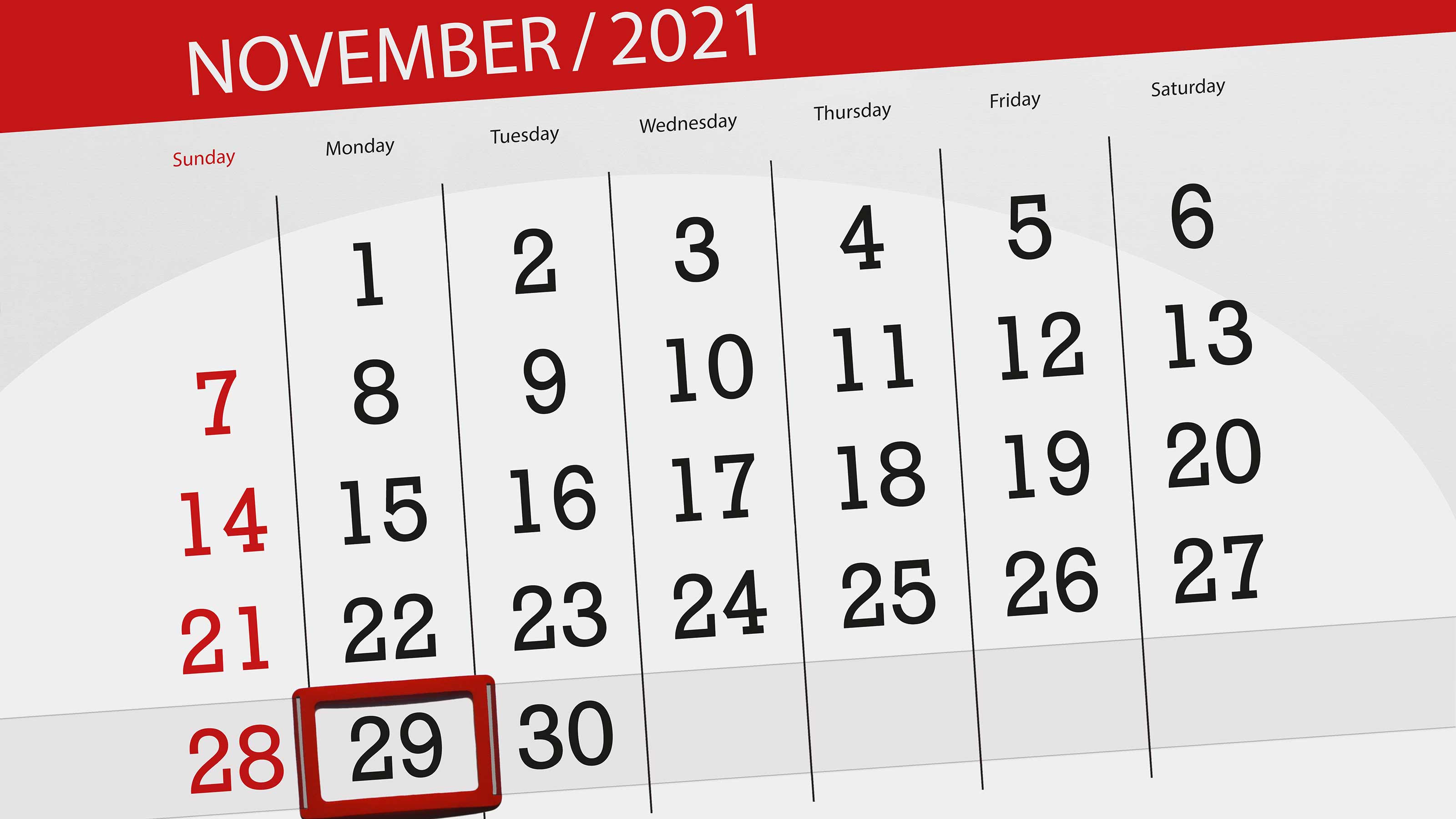

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Tax Credit United States Wikipedia

Irs Updates Child Tax Credit Direct Deposit Portal Gobankingrates

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit 2022 How To Claim The New Payments On Getctc Marca