does nevada tax your retirement

Nevada is extremely tax-friendly for retirees. How does nevada tax retirees.

Nevada Retirement Tax Friendliness Smartasset

Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level.

. 800-352-3671 or 850-488-6800 or. The Silver State wont tax your pension incomeor any of your other income for. Retirement income exempt including Social Security pension IRA 401k 7.

To figure out your provisional income begin with your adjusted. Its currently one-half of one percent and was. No state income tax.

Retirement income exclusion from 35000 to 65000. No state income tax. No Nevada does not tax military retirement income as theres no state income tax in Nevada.

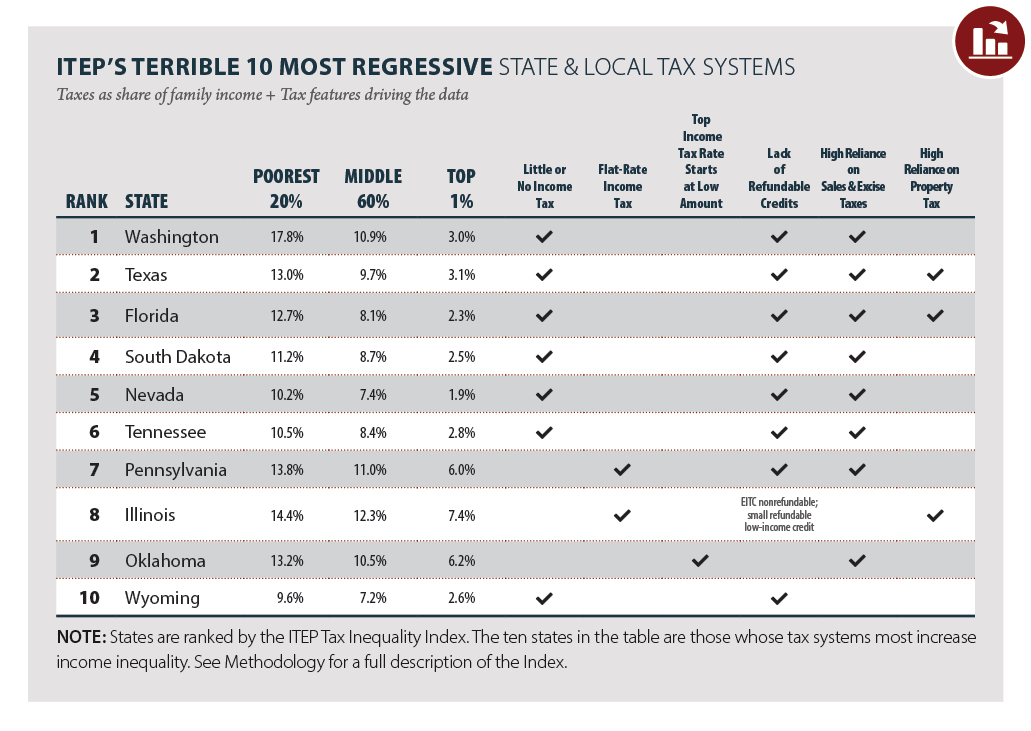

If you have provisional income you may have to pony up federal income tax on as much as 85 of your benefits. A use tax proposal is on the ballot for voters in Nevada as is the extension of a capital improvements sales tax. By comparison Nevada does not tax any retirement income.

In general retirement assets are located in taxable accounts your after-tax investments tax deferred accounts your IRAs and 401k andor tax-free accounts primarily. Since Nevada does not have a state income tax any income you receive during. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state.

404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Veterans who live in Nevada may also benefit from property tax exemptions. 4 hours agoNEVADA Mo.

Retirees in Nevada are always winners when it comes to state income taxes. This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State. If youre at least 59½ years old the Magnolia State wont tax your retirement income.

However the state will take its share of 401 k IRA or. This includes income from both Social Security and retirement.

Is Arizona State Retirement Income Taxable

Arizona Vs Nevada Which State Is More Retirement Friendly

7 States Without Income Tax And What You Need To Know Thestreet

12 States That Won T Tax Your Retirement Income Kiplinger

Retiring In Las Vegas Pros And Cons For Sin City Seniors

Do You Pay Taxes On Pensions From The State You Retired In Or The State You Re Living In

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

States That Won T Tax Your Federal Retirement Income Government Executive

Nevada Vs California Taxes Explained Retirebetternow Com

Don T Assume Your Taxes Will Be Lower In Retirement Due

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

Which States Are Best For Retirement Financial Samurai

Nevada Retirement Taxes And Economic Factors To Consider

Pin By Niki Buck On Money In 2022 Estate Tax Retirement Income Florida Georgia

Financial Benefits Of Moving To Nevada Mariner Wealth Advisors